This week the coronavirus stimulus checks have started to roll out to those who filed their 2018 and 2019 taxes and signed up to receive federal funds through direct deposit. If you’ve met the minimum qualifications for a payment — your annual income is below $75,000 and you e-filed your taxes — it’s likely you have your money already. If you don’t, it’s for one of two reasons. Either you’re just one of the unlucky few who hasn’t received theirs (funds will be distributed over the next three weeks) or you were listed as a dependent on your parents 2019 taxes.

In our breakdown of the coronavirus stimulus bill, we mentioned that some people would inevitably fall between the cracks and bureaucratic language of the bill, and one of those vulnerable groups it turns out is young people between the ages of 17 and 24. Here is where it gets frustrating: If your parents listed you as a dependent, then they’ll receive an additional $500 added atop their stimulus check, so long as you’re 17. So if you were listed as a dependent in 2019, between the ages of 18-24, and in desperate need of funds because either you’ve suddenly found yourself out of work, or your parents don’t support you financially, you’re unfortunately out of luck. Elaine Maag of the Urban-Brookings Tax Policy Center told Vox that by her estimations that equals out to about 9 million people who won’t receive any federal funds for coronavirus relief.

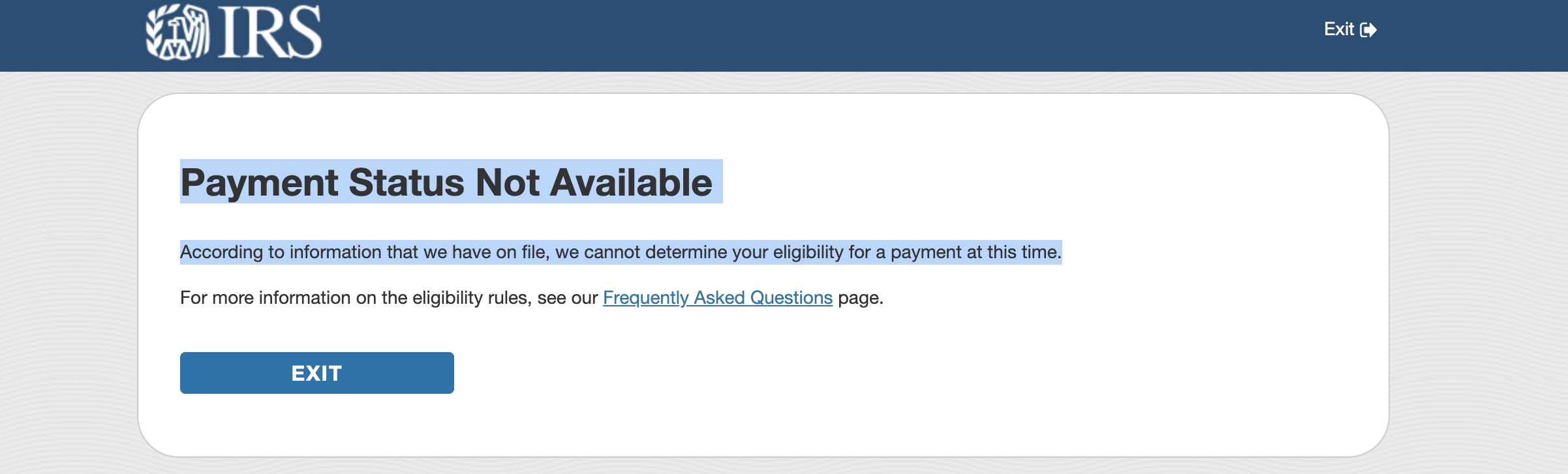

That’s that, unfortunately. Sorry, but we don’t have any good news for you and the IRS is not offering a remedy to your particular situation. For those of us 25 and older who still haven’t gotten paid, the IRS launched a handy tool yesterday to help track your refund. Unfortunately, a lot of people who qualify for the $1,200 check are getting the following message from the IRS:

“Payment Status Not Available. According to information that we have on file, we cannot determine your eligibility for a payment at this time.”

Don’t worry, this doesn’t necessarily mean the IRS doesn’t have your information. A lot of people are getting this message, some filed their 2019 tax returns late, some filed 2018 but not 2019, and some filed their taxes as soon as they received their returns back in January and February so it doesn’t seem to be related to WHEN you filed your taxes. It’s likely an IRS glitch or temporary message as the IRS continues to process the returns.

Visit the IRS website to check the status of your money but keep in mind that an excess of three logins per day will lock you out of the system for 24 hours. So check it once, and if you received the above message don’t expect to see your funds until at least tomorrow.