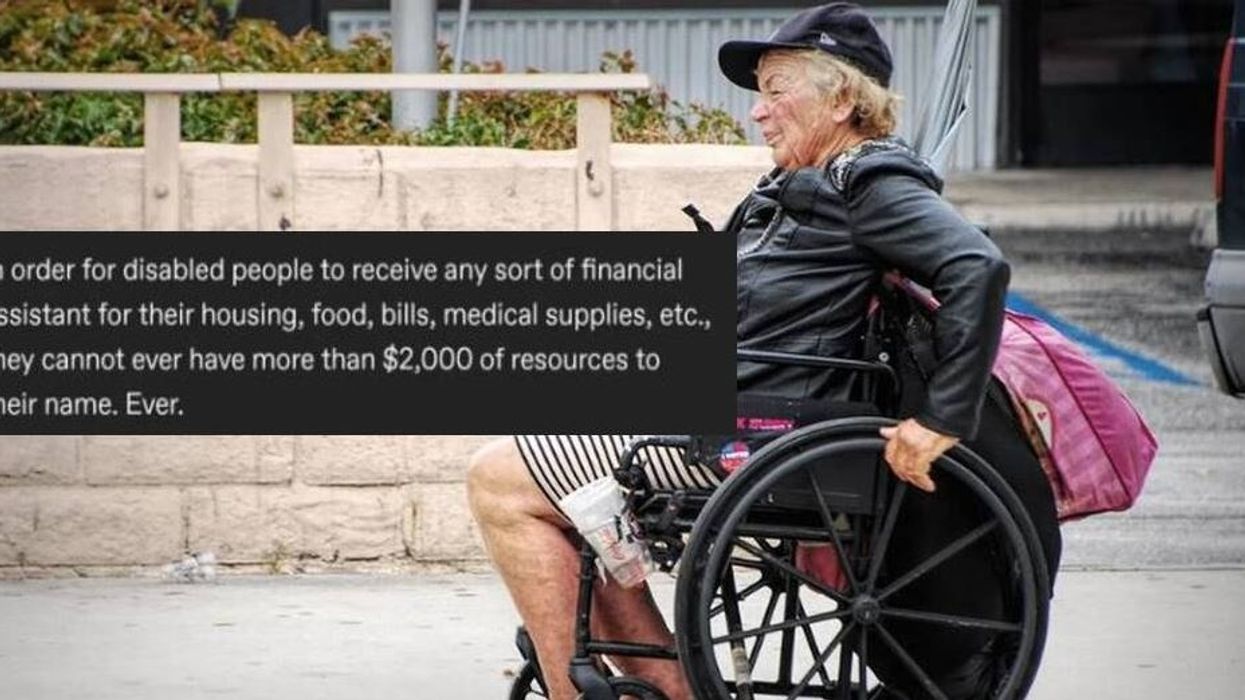

An eye-opening Tumblr thread posted to Reddit shows how federal Supplemental Security Income (SSI) programs designed to help disabled people actually help keep them in poverty.

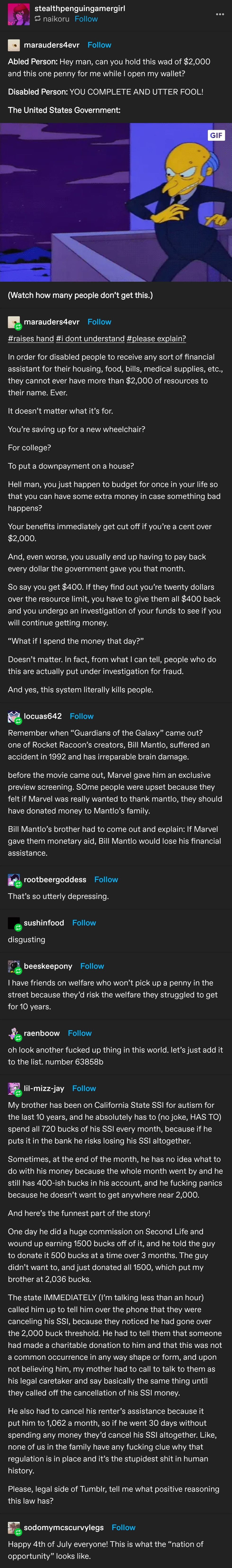

Reddit user iDogeYT posted this thread that explains how people with disabilities are not allowed to have more than $2,000 to their name or the benefits they depend on are automatically shut off.

This leaves them unable to save for a rainy day, educational opportunities, or to buy a home or car.

via Reddit

via Reddit

According to Disability Secrets, “To be eligible to receive SSI benefits based on disability, an SSI applicant or a current SSI recipient who is single cannot have more than $2,000 in assets.”

If the disabled person is married (even if only one person is eligible for disability), the asset limit is $3,000. The only assets the able-bodied spouse can have are an IRA or pension plan.

If the disabled person has a child under the age of 18, they are only allowed $2,000 in resources.

Resources that are counted in the $2,000 limit, include:

— Money in a checking or savings account

— Cash value in life insurance policies (over $1,500)

— Stocks and bonds

— Household goods and personal effects (over $2,000)

— Motor vehices (except for one), and

— Real estate (other than the home in which a claimant resides)

If a person on disability exceeds their asset limits their benefits can be immediately cancelled.

So, to put it simply, the same program that’s supposed to help disabled people can keep an entire family impoverished and unable to accumulate any assets.

There is one way that disabled people can accumulate assets, through the Achieving a Better Life Experience program. This allows people who experienced an “onset of disability” before the age of 26 to put up to $100,000 in tax-advantaged savings without having their disability benefits affected.

Since the act was passed in 2014, over 34,000 people have opened up ABLE accounts and over $171.7 million have been invested. The program is available in 41 states and Washington, D.C.

However, what if you became disabled after the age of 26? What if you were the victim of an accident or had a disease? What if you returned home from war in Iraq with a missing limb? Then sorry, you can’t have more than $2,000 in your bank account.

Democratic Senator Bob Casey from Pennsylvania is trying to change the law so more people with disabilities are eligible for ABLE accounts. He has sponsored the ABLE Age Adjustment Act which would raise the age for the onset of a disability to 46 and allow up to 6 million more people save for the future.

“Sometimes the onset of a disability can occur much later in life,” Casey told a small crowd of individuals with disabilities last year.

Disability programs are designed to give people more independence, not confine them to a life of poverty. In a capitalist society where cash is king and social programs are lean, financial independence is as important as being physically or mentally independent.

The government should reconsider its punitive limits on the assets of disabled people so they can become more independent and and have a greater chance to be fully integrated into society.