You know how sometimes you see something come through your social media feed and you think, “There’s no way that’s real,” only to then have your mind blown when you find out it actually is real?

This is one of those times.

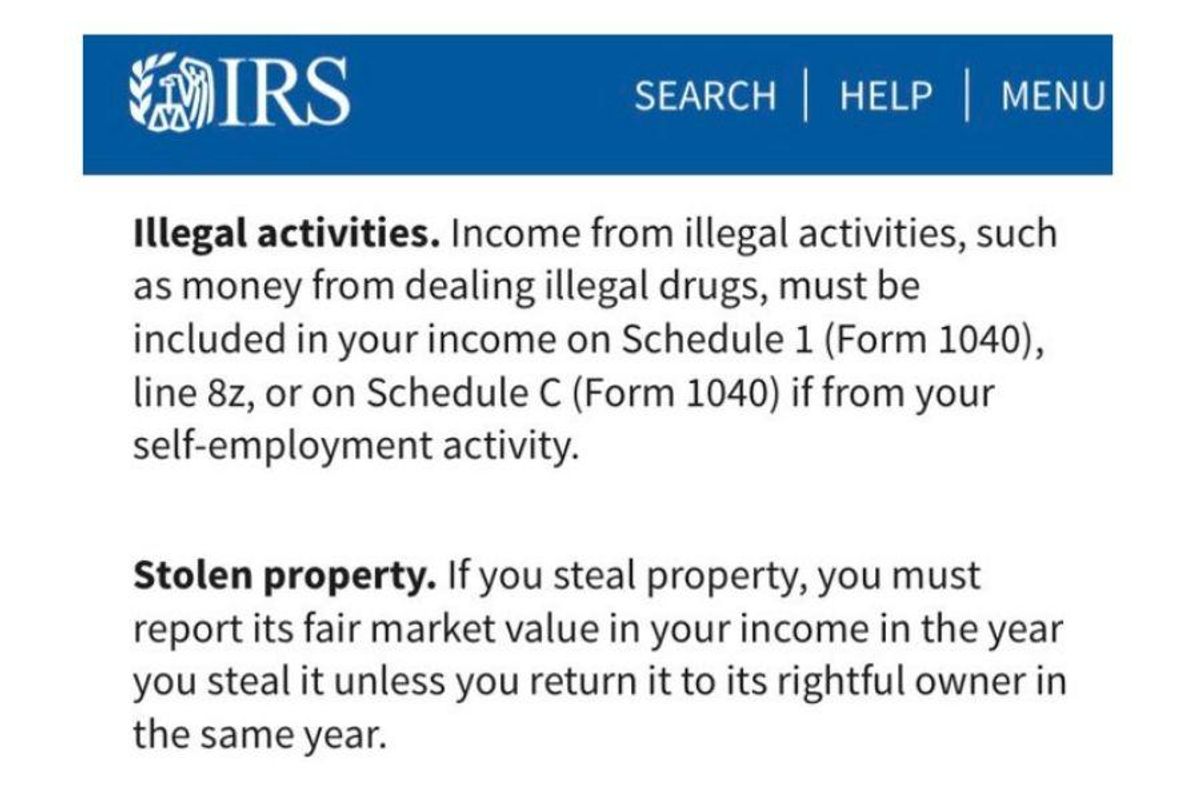

Twitter user @litcapital shared a post that appeared to be a screenshot from the IRS website with two entries on it:

“Illegal activities. Income from illegal activities, such as money from dealing illegal drugs, must be included in your income on Schedule 1 (Form 1040), line 8z, or on Schedule C (Form 1040) if from your self-employment activity.

Stolen property. If you steal property, you must report its fair market value in your income in the year you steal it unless you return it to its rightful owner in the same year.”

Yes, you read that right. Dealing illegal drugs? Gotta pay taxes on that income. Stealing property? Gotta report that as income.

Tax szn is around the corner. Remember to report your income from illegal activities and stolen property to the IRSpic.twitter.com/c4S1yMZJLz— litquidity (@litquidity)

1640623591

Surely this is made up, right?

Nope. Go here: https://www.irs.gov/publications/p17. Do a “Find” search with your browser and enter the word “illegal.” Then put in “stolen.” You’ll find the entries listed under “Other Income,” worded just like this.

We can all agree that taxes are overly complicated, and few of us have the time to read through every single IRS publication to figure them out. But requiring criminals to report illegal activity and stolen goods on their taxes? Really?

Someone had to actually come up with this policy. Someone had to say, “Hey, I think we should tell criminals that they have to report their criminal profits on their taxes,” and someone else had to say, “Yeah, that’s a good idea.” Someone had to approve it. Someone had to type it up and publish it, too.

Did they all do this with a straight face? Was it a serious conversation? Did any brave soul say, “Um, that’s stupid. No one is going to do that,” because it’s obviously stupid and clearly no one is going to do that?

That was my first thought upon seeing these tax requirements.

Add seven zeros to your example and youu2019ve just explained how corporate accounting works.— Jimmy (@Jimmy)

1640647896

However, as it turns out, there actually is a good reason these policies exist. Illegal income does get reported sometimes, namely when someone has been caught (or thinks they’re about to be caught) in some illegal activity and they don’t want to get hit with a tax evasion charge in addition to whatever financial or property theft crime they’ve committed.

According to CNN Money, New England accountant Tom Hughes paid taxes on money he stole from his clients in 1999, 2001 and 2004. “I knew the money was taxable, there was no doubt about that,” Hughes told the outlet. “I had already been caught, and I didn’t want to face federal tax charges.”

He now gives speeches on financial crime and professional responsibility. Go figure.

However, Hughes is the exception, as tax experts told CNN that most criminals don’t report their illegal incomes. Duh. According to San Francisco tax attorney Stephen Moskowitz, most of those who do are facing embezzlement charges and are trying to avoid Al Capone-ing themselves. He has helped some of those clients document their illegal gains to avoid doubling their legal trouble due to illegal tax activity.

I see this ridiculed a lot, and it is funny on the face of it, but it’s not a ridiculous thing. In order to bust someone for evading taxes on income from illicit activity, you have to have a rule against it. Anti-murder laws also seem funny from a certain angle.— Dan Mitchell (@Dan Mitchell)

1640627136

So basically, we have to have official tax requirements for illegal income in order for criminals to not be able to get away with tax evasion for that income. Still seems like a bizarre policy to actually write out in words, though, even if it makes sense from a legal perspective.

Humans are weird and money is weird and both things just seem to keep getting weirder. Yay us.