First it was Matt Damon and Spike Lee, and now the blockchain has come for Larry David and Lebron James. David and James became the latest celebrities to endorse cryptocurrency, in Super Bowl commercials aired this Sunday — David as a character mocking great ideas throughout history in an ad for the Bahamian crypto exchange FTX, and present-day Lebron James traveling back in time to Biff Tannen his digitally de-aged teenage self into buying crypto in an ad for Crypto.com, a Singapore-based exchange app.

As far as Super Bowl ads go, neither was the worst I’ve ever seen (far fewer corporations apologizing for scandals and promising to do better this year), and David’s was actually reasonably funny — at least, right up until the moment it became clear that it was an ad for crypto, which felt more like a revelation than a punchline. They got to Larry David?

It was one thing to see Spike Lee in a Bitcoin spot or Gwyneth Paltrow promoting buying Bitcoin via Cash App or Kim Kardashian and Floyd Mayweather promoting an apparent EthereumMax pump and dump, but a famously crotchety trend hater like Larry David jumping on the bandwagon felt like a particular kind of persona betrayal. That persona was essentially the entire basis for the ad, which was directed by David’s long-time Curb Your Enthusiasm collaborator Jeff Shaffer, whom, as you might’ve already guessed, was not paid in crypto.

Between David, Lebron James, Tom Brady and Gisele Bundchen (subjects of a separate campaign for FTX), Gwyneth Paltrow, Kim Kardashian and Floyd Mayweather — all of them basically as rich as it’s possible for any famous person not famous specifically for being rich itself to be — it seems part of a deliberate strategy to choose crypto spokespeople who very plainly don’t need the money. The “why the hell are they doing this” of it all is practically baked in.

The answer? Paradoxically, it has to be money, right? What else could it be?

Perhaps there was some earlier age of greater assumed social responsibility than today, when otherwise putatively socially conscious celebrities would’ve been more reticent to promote an at best highly speculative and at worst environmentally destructive investment strategy. Whatever the case, some of our richest celebrities have clearly determined that the upside of hawking crypto outweighs the social costs.

Which is to say: the only way I can wrap my mind around Larry David agreeing to star in a crypto ad is that they were offering him so much money that he would’ve felt like an idiot to turn it down.

If the first question this massive crypto ad push raises is, “why did these celebrities agree to do this?” And the most logical answer is “because they got paid an obscene amount of money to do so,” the next logical mystery is how these crypto companies have so much money to blow in the first place.

The figures are staggering. According to the LA Times, Larry David’s ad cost up to $7 million just for the air time. Which doesn’t include however much they paid David and Shaffer, the $100,000-a-day production, and fees to all the agencies involved in its creation (“the ad and public relations agencies 360i, dentsu X, and Mitchell in addition to dentsuMB; the production company Partizan; and editors at Mackcut”). According to a New York Times piece, the company behind the ads, FTX, recently spent $17.5 million to sponsor sports at Cal, paid $20 million for the aforementioned Tom Brady/Gisele ad campaign, and bought the naming rights to the Miami Heat basketball team’s home arena for $135 million.

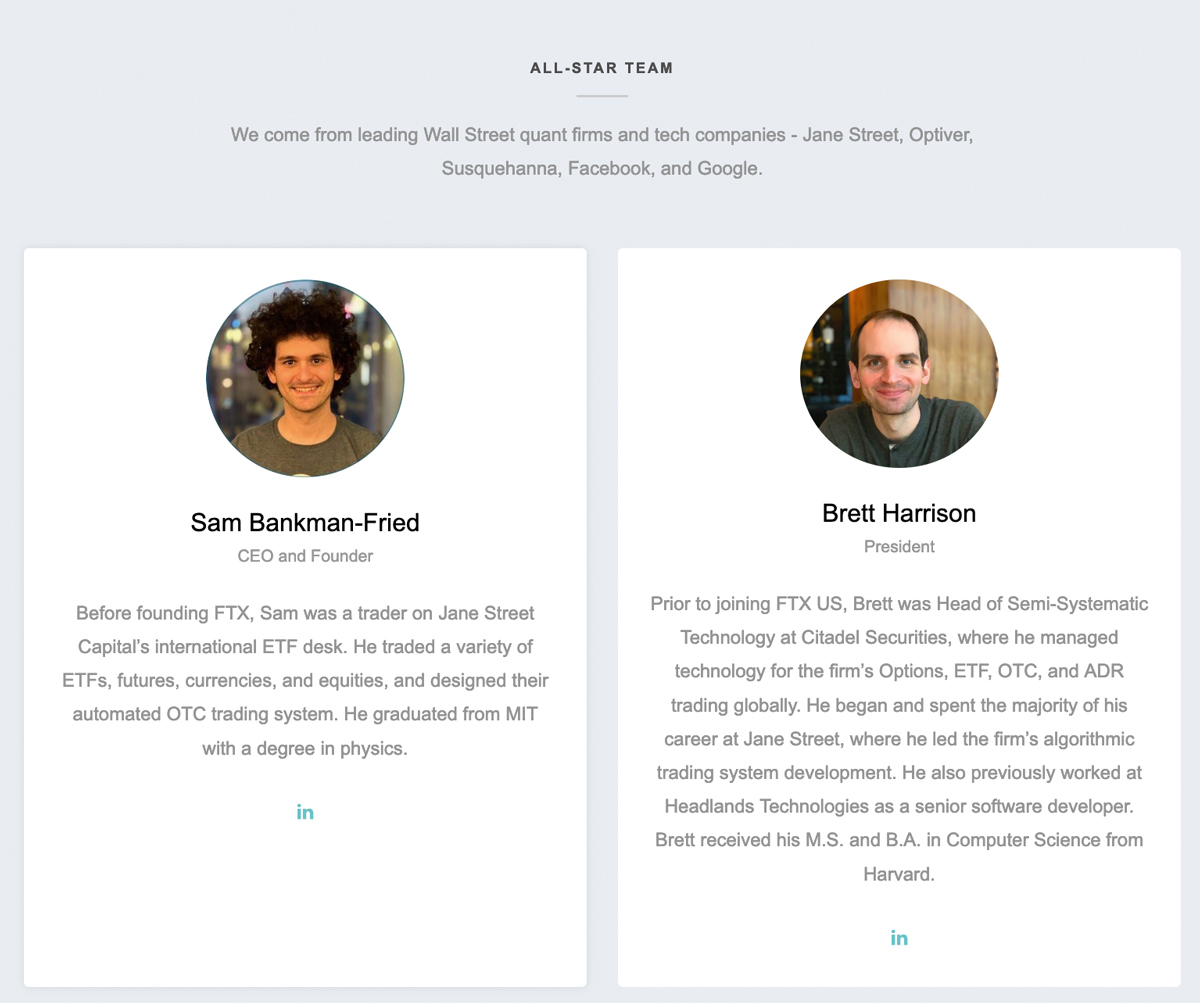

Incredibly, FTX is a company that has only existed since 2019. Its founder is a 29-year-old multi-billionaire* named Sam Bankman-Fried (*”though such estimates are fuzzy—many of Bankman-Fried’s digital assets are illiquid, of speculative value, and just plain weird,” as noted by Yahoo Finance) who first set up shop first in Hong Kong and, as of this past Fall, in the Bahamas — in both cases, it seems, in order to find a friendlier regulatory environment for his business.

As the Yahoo Finance profile of Bankman-Fried published in August put it, there are two types of crypto exchanges, the kind that operate in the US, which have been designed to comply with some of the “cumbersome” US regulations, and the second kind:

…like BitMEX, Binance, Bitfinex, and FTX’s international exchange— [which] have taken a much riskier approach. They have set up offshore, and have offered a wide array of innovative products, including crypto futures, swaps, other derivatives, and ‘tokenized stock’ (digital assets said to be tethered to actual stock holdings held by a custodian somewhere, like, in FTX’s case, a German bank). The offshore exchanges have also let traders—including unsophisticated retail traders—buy many of these volatile instruments on margin. Until last month, for instance, several exchanges, including FTX, spotted their customers margin ratios as high as 100:1; that is, you could buy a $100,000 position in a crypto derivative with just a $1,000 deposit. One big price swing—hardly unusual in crypto markets—can result in automated margin calls that wipe out a trader’s position.

Does anyone else miss the days when some talking frogs wanted us to drink more beer? Even the question of whether this exchange, which spent hundreds of millions of dollars advertising to a majority-American audience, is even legal to use in the US seems to get complicated in a hurry. According to the same profile on FTX’s CEO Sam Bankman-Fried: “In hopes of evading U.S. regulators, the offshore exchanges, including FTX, all say they refuse orders from U.S. customers.”

FTX’s own legal page reads:

“FTX does not allow residents of the United States of America to trade on its platform.

– FTT is not offered in the United States of America.

– FTX.US, a separate trading platform not owned by FTX, does operate in the United States, and maintains a variety of US regulatory licenses, including an MSB, MTLs, DCO, DCM, and SEF.”

This page includes a link to FTX.us, which, again, is described as “a separate trading platform not owned by FTX.” The About page on FTX.us in turn looks something like this:

Yes, that’s a picture of FTX.US CEO and founder, Sam Bankman-Fried. I don’t know enough about corporate law to understand the legal definitions of “a separate trading platform not owned by FTX,” but when the founder is the same guy it feels like there are some crucial corporate loopholes being utilized. (We all know that corporations are legally people, but isn’t it also true that corporations are legally not people?)

I read the entire profile on Bankman-Fried, and I still don’t quite understand the convoluted legality of cryptocurrency. Though I did learn that Bankman-Fried was Joe Biden’s second-biggest individual donor behind Michael Bloomberg, that he describes himself as a “radical utilitarian,” that he sleeps four hours a night on beanbag chairs, and that his parents teach at Stanford, his father mostly on the subject of tax policy (a great job for a guy named “Bank Man,” to be sure).

Meanwhile, the Super Bowl’s other biggest cryptocurrency ad came from Crypto.com, a Singapore-based company that recently paid $700 million to have the Staples Center renamed the Crypto.com Arena. Crypto.com’s four cofounders, also apparently based in Hong Kong and Singapore, seem to keep lower profiles than Bankman-Fried. Though the Daily Beast reports that Kris Marszalek, Crypto.com CEO, left his last job, at an Australian version of Groupon called Ensogo, “amid accusations from customers and business partners that they had been ripped off.”

Which explains… well, not much. Virtually the entirety of the crypto world, and the players in it, feels sketchy and obtuse, something to handwave away without thinking about like your iTunes terms and conditions on your way to FUN and PROFIT. And that, in and of itself, would seem to offer an explanation as to why cryptocurrency companies are spending such insane amounts of money on advertising in the first place: legitimacy. They want us to imagine purchasing a volatile asset on a pseudo-legal exchange to be as commonplace as drinking a beer or driving a pickup truck.

Clearly it’s not, and the more hundreds of millions of dollars they pay celebrities to convince me otherwise, the warier I become. It also seems telling that almost all of those ad dollars have gone towards traditionally male-skewing things, like football and MMA. Which calls to mind a particular exchange in the movie Boiler Room:

Greg Weinstein (Nicky Katt): Now there’s two rules you have to remember as a trainee, number one, we don’t pitch the bitch here.

Seth Davis (Giovanni Ribisi): What?

Greg Weinstein: We don’t sell stock to women. I don’t care who it is, we don’t do it. Nancy Sinatra calls, you tell her you’re sorry. They’re a constant pain in the ass and you’re never going to hear the end of it alright? They’re going to call you every fucking day wanting to know why the stock is dropping and God forbid the stock should go up, you’re going to hear from them every fucking 15 minutes. It’s just not worth it, don’t pitch the bitch.

It should be noted that Boiler Room was a film about a pump-and-dump scheme. Maybe the crypto era will eventually end the same way, with an FBI raid and a truck full of computers. Or maybe the fatal flaw of the Boiler Room scheme wasn’t that it was illegal, maybe it was that it wasn’t complicated enough and JT Marlin Investments didn’t spend enough on advertising.

Vince Mancini is on Twitter. You can access his archive of reviews here.

30 under 30 for another year

30 under 30 for another year (@imperatoryvette)

(@imperatoryvette)