Elyse Lyons, a 28-year-old from Nebraska, is a money blogger and budgeting whiz who conquered a whopping $34,000 in debt over two years by having “no-spend months.” During no-spend months, the goal is to spend as little money as possible each day.

“When I was 22, I was in $34,000 worth of debt because I had student loans, car payments, and some credit cards,” she told Good Morning America. “And I knew that if I wanted to enjoy my life a little bit more, I had to pay it off.”

That’s when she devised her no-spend month strategy.

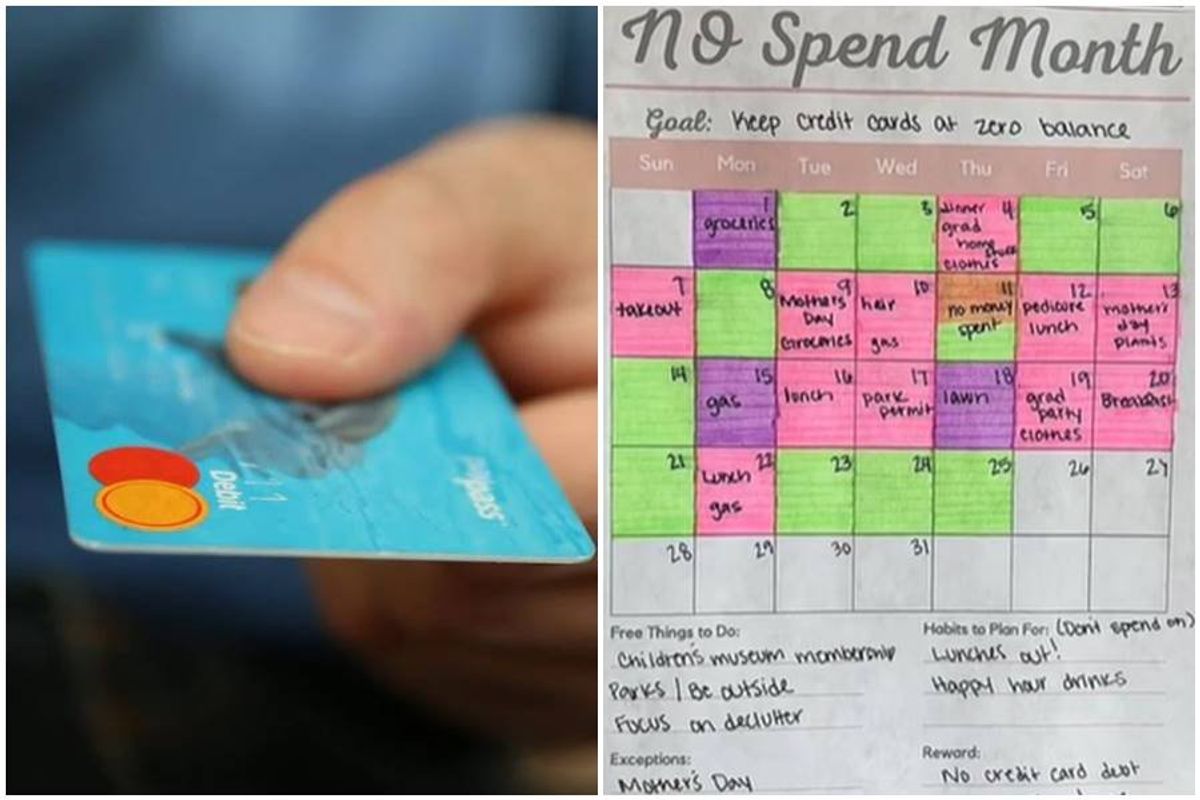

If you’re looking to save money like Lyons, she recommends buying a calendar and jotting down the few days you might need to part with some cash, such as buying gas for your car or going food shopping. The calendar is also a way to track and celebrate your money-saving wins. It’s a fun, visual reminder of your journey to financial freedom.

She also recommends making a list of things you didn’t buy, and if you keep returning to that item, find a way to put it in the next month’s budget. The entire process is all about being intentional and conscious about your spending habits.

“The goal is not to create shame around spending. It’s to see who you are at your core and what your actual spending habits are about,” Lyons said. She also said the goal shouldn’t be to restrict yourself to spending $0 daily.

“Extreme deprivation is not going to work for your budget for long,” she added.