Our tireless pursuit to find the best bottles of scotch whisky at every price point has landed us in one of the first prime price points. Bottles of scotch between $40 and $50 are where things really start to get interesting. This is the range where the blended scotch gets really good and the single malts start to pop.

Granted, those single malts are still pretty young. But they’re solid and offer a nice baseline for newcomers to sippable Scotch whisky.

As for the prices of each of these bottles, well, that’s going to vary greatly depending on which coast you’re on (it simply costs more money to get this stuff to the West Coast, folks), which state you’re buying the bottle (local taxes range wildly), and which store you’re in. Because as Pappy proves, stores can charge whatever they want for this stuff depending on demand.

All of that being said, these bottles are going to be worth the search and the cash. The defining factor for each bottle’s inclusion on the list is that it is a great tasting bottle of scotch at a fairly accessible price point. Sure, you can get two quality bottles of bourbon for the price of most of these bottles. But where’s the fun in that?

The Singleton of Glendullan 12

ABV: 40%

Average Price: $40

The Whisky:

This single malt from Diageo is a great gateway to single malt. The juice is aged for 12 years mostly in ex-bourbon barrels and blended with a few ex-sherry cask-matured whiskies before it’s cut with that iconic Speyside water and bottled.

Tasting Notes:

This is a delicate sip of whisky that leans into notes of dried florals and sweet fruits counterpointed by spicy oak and worn leather. The palate lets the spice amp up a bit while the fruit touches on both orange oils and orange blossoms with whispers of bourbon vanilla, dried fruits, and fresh honey. The end really holds onto that lightness while fading fairly quickly, leaving you with a cedary leather, more of that sweet fruit, and almost creamy vanilla.

Bottom Line:

This Diageo single malt was originally conceived for the travel market, meaning it was only found at duty-free shops. Its wild popularity allowed this one to go worldwide and we’re all luckier for it. Try it in a highball and cocktail. It also works really well as an easy-sipping scotch on the rocks.

SIA Blended Scotch Whisky

ABV: 43%

Average Price: $43

The Whisky:

SIA Whisky is the result of Carin Luna-Ostaseski’s passion for the good stuff from Scotland. Luna-Ostaseski successfully launched this whisky through Kickstarter, making the first crowd-sourced whisky. The actual juice in the bottle is a blend of Speyside, Highland, and Islay juices with a 60/40 grain whisky or malt whisky ratio.

Tasting Notes:

There’s a marrying of bright orange zest with a five-spice matrix lurking underneath. The citrus really brightens things up as hints of vanilla pudding, honey, buttery toffee, and fatty nuts balance out the flavor with a very distant wisp of that Islay smoke. The end is well-rounded, nutty, and full of vanilla cream, all finishing on a slightly sweet smoky note.

Bottom Line:

This really is a solid newcomer to the world of blended scotch. It’s very sippable on the rocks but also builds a nice cocktail.

Johnnie Walker Green Label

ABV: 43%

Average Price: $43

The Whisky:

The blend is a “pure malt” blended whisky, meaning that it’s made only with single malts (usually blended scotch is made with both grain and malt whisky). In this case, the juice is pulled from all over Scotland with a focus on Speyside, Highland, Lowland, and Island malts, including a minimum of 15-year-old Talisker, Caol Ila, Cragganmore, and Linkwood.

Tasting Notes:

This sip draws you in with the smells of an old, soft cedar box that’s held black pepper, sweet fruits, and oily vanilla pods next to a hint of green grass. The taste really holds onto the cedar as the fruits lean tropical with a hint of dried roses pinging in the background. The end builds on that by adding a note of spicy tobacco, a splash of sea spray, and a distant billow of campfire smoke.

Bottom Line:

A lot of people love this bottle (us included). If you can find it, it makes one of the best highballs you’ll ever taste while also working perfectly well as a sipper on the rocks or a cocktail base.

Jura 10

ABV: 40%

Average Price: $44

The Whisky:

This Island whisky from the Inner Hebrides is designed to marry the sea to the earth. The juice spends ten years resting in ex-bourbon barrels literally next to the sea. The juice is then married and put into ex-sherry barrels for a finishing maturation. The result is proofed with local water and bottled.

Tasting Notes:

Slight wafts of apricots and plum lead towards a sharp black pepper spiciness and a very distant whiff of sweet smoke. The stonefruit keeps a throughline in the sip as the spiciness leans more fresh ginger and choco-coffee bitterness peeks in (especially when water is added). The medium-length end touches on the fruit, spice, and bitter notes with a final touch of that smoke ending the sip.

Bottom Line:

This is a really easy-drinking dram thanks to that fruity nature. Pour it over some rocks and sip or mix it into a killer cocktail.

Ardbeg 10

ABV: 46%

Average Price: $45

The Whisky:

This is a classic bottle of peated malt. The Islay whisky is made with locally peated smoky malts and then primarily matured in ex-sherry casks for the years. Those casks are married and then cut with local lake water before bottling.

Tasting Notes:

There’s a clear sense of stonefruit, orange oils, and earthen peaty smoke that greets you. The palate leans into the iodine and earthiness with plenty of campfire smoke next to black pepper, vanilla, and an underlying nuttiness. With a little water, a coffee bitterness arises next to a hint of black licorice. The end really embraces the smoke, adding fattiness like an old meat smoker as the fruit and nuts make a final appearance on the very slow fade.

Bottom Line:

This is the ultimate peat introduction. It’s bold, forceful, and imbued with Islay peat at every level. It’s also going to vary pretty wildly where the price is concerned. Try it on the rocks first to take the harsher edges off and go from there.

Aberfeldy 12

ABV: 40%

Average Price: $45

The Whisky:

This Highland malt is the cornerstone of the much-beloved Dewar’s Blended Scotch. This whisky is a very accessible single malt that spends 12 years resting before it’s married and proofed with that soft Highland water and bottled.

Tasting Notes:

The heart of the nose is in the mingling of pear and honey with a hint of Christmas spice, especially nutmeg. The palate expands on that with a lush maltiness, creamy vanilla, mild spice, and more of that honey and orchard fruit. The end gets slightly nutty and bitter with a little water as the honey, fruit, and spice linger on the senses.

Bottom Line:

This is a solid sipper but really shines as a cocktail base.

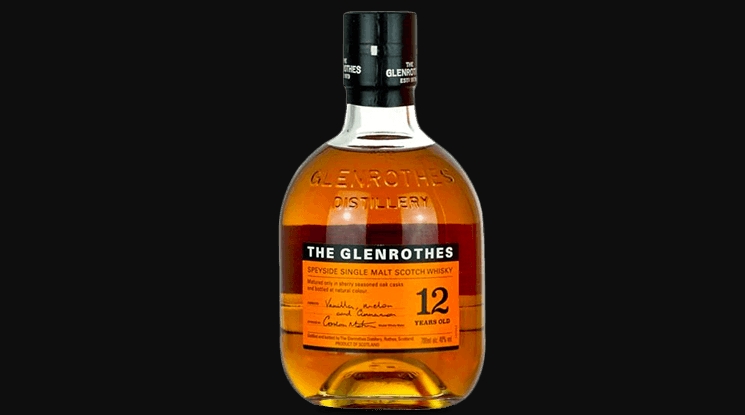

The Glenrothes 12

ABV: 40%

Average Price: $46

The Whisky:

This Speyside whisky really exemplifies the Spanish sherry tradition. The juice is aged in ex-sherry casks and then built to highlight the plummy, nutty, and dried fruit depths of those flavors in blending and proofing.

Tasting Notes:

Imagine ripe bananas fried in butter with a vanilla pod next to a touch of ginger and sherry mustiness. The palate really lets the dried fruit kick in as the mouthfeel leans creamy vanilla as hints of roasted nuts, spicy stewed prunes, and pipe tobacco mingle with a slight note of lemon oil. The finish is long with a bit of that plummy sherry leading the fade as a final note of savory fruit pops at the very end.

Bottom Line:

This is a really interesting sipper in this age range. It does need a little water (which will reveal some coffee and dark chocolate bitterness with a herbal edge). Still, take your time with this one.

Glenmorangie The Original 10

ABV: 40%

Average Price: $46

The Whisky:

Glenmorangie The Original is the ultimate gateway scotch, especially to the Highland brand’s long list of specialty finished whiskies. This juice spends ten long years resting in ex-bourbon casks before blending, proofing, and bottling.

Tasting Notes:

Peaches swimming in creamy vanilla are countered by a rush of bright lemon zest. The palate really lets the vanilla shine with a mild maltiness next to hints of dried flowers and orange rinds. That orange lightens on the medium-length end as the vanilla fades with a hint of spice and wood, leaving you with a final burst of that bright citrus and creamy peach.

Bottom Line:

While this is a really solid “on the rocks” sipper, it’s best used in cocktails. Try it in your next Rob Roy.

GlenDronach 12

ABV: 43%

Average Price: $47

The Whisky:

This Highland expression has made a big comeback after a hiatus. The whisky is all about the sherry casking, having spent 12 years maturing in both Pedro Ximenez and Oloroso sherry casks. The juice is then married and proofed with soft Highland waters and bottled with no other fussing.

Tasting Notes:

There’s a hint of spicy stewed pears up top next to a creamy vanilla pudding that’s been cut with a touch of fresh ginger. The palate goes full mulled wine with plummy sweetness — Christmas spices, hazelnuts, and dried fruits. The end is very jammy and spicy while fading slowly through the senses.

Bottom Line:

This makes an awesome Manhattan (well, Rob Roy technically) or old fashioned while also being a perfectly fine sipper with a little water.

BenRiach The Original 10

ABV: 43%

Average Price: $48

The Whisky:

Master Blender Dr. Rachel Barrie helped reinvent Speyside’s BenRiach last year with a whole new batch of releases, including this one. The juice is triple-barreled in ex-bourbon, ex-sherry, and new (or virgin) oak. Those whiskies are then blended to create this very drinkable dram.

Tasting Notes:

There’s a subtle vanilla cake foundation that’s tinged with orange oils, cedar, and lemon custard. The taste touches on red berries, peaches and cream, and more of that cedar while also reveling in cinnamon spice with a baked buttermilk biscuit body. The stonefruit and creaminess last the longest, as the sip fades fairly quickly and surprisingly lightly through your senses.

Bottom Line:

This has no business being as sippable as it is at this price. It’s really well-rounded and barely needs any water to take the edges off.